do i have to pay tax on a foreign gift

Citizen spouses are free of gift tax. No the IRS does not impose taxes on foreign inheritance or gifts if the recipient is a US.

Foreign Nationals And U S Gift Tax Consequences Of Executing Certain Real Property Deeds Kerkering Barberio Co Certified Public Accountants Sarasota Fl

And you will not be required to pay an income or foreign gift tax.

. Although youll pay no taxes youll file Form 3520 at tax time reporting all gifts received from overseas on that form. Paying Tax on Gifts Received from Abroad. Although you probably wont have to pay United States taxes on your foreign inheritance as an expatriate reporting it to the IRS is still necessary.

You might have to pay taxes on transfers you receive if they were income. Otherwise you must file IRS. If you are a US.

You must to pay taxes on gifts you send if youve given more than 1158 million in your lifetime. Gifts of up to 100000 per year to a non-US. Person who received foreign gifts of money or other property you may need to report these gifts on Form 3520 Annual Return to Report Transactions with Foreign Trusts and.

Gifts by foreign nationals not domiciled in. The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full. No gift tax applies to gifts from foreign nationals if those gifts are not situated in the United States.

In order to keep tabs on American money. The penalty for failing to file each one of these information returns or for filing an incomplete return is five 5 percent of the gift per. Citizen or resident alien.

Although the IRS will not tax the actual inheritance you will still. While you may not need to pay tax on large sums of money being sent abroad. Citizens spouse can be given free of tax.

In cases where gifts are taxable the sender is required to pay tax not the recipient. The fact that the gift is from a foreign person is irrelevant. However you may be required to furnish proof that you paid any estate or gift tax to a foreign government.

This rule stands for. In legal terms the gift isnt US. The gift tax rate fluctuates from 18 to 40 percent depending on the size of the gift.

For instance if you give someone a gift worth between 20000 and 40000 the marginal gift tax rate is 22. Do I Have To Pay Tax On A Foreign Gift. Gift Tax for Nonresidents not Citizens of the United States.

As the recipient of the gift you do Not report the gift on a US tax return regardless of the amount received. Therefore if you receive a monetary gift or an inheritance from relatives abroad you will not have to pay taxes. However since the gift is from a foreign person you must report the gift received to.

If you are given money from a United States citizen as a gift you do not have to declare it or pay tax on it. Cash gifts can be subject to tax rates that range from 18 to 40 depending on the size of the gift. Typically if a foreigner gifts money or property except intangibles such as.

Gifts to US. When money is transferred overseas as a gift you may not have to pay taxes on it. Penalties for Not Reporting a Gifts From Foreign Person.

Gifts from foreign persons gifts from foreign persons. However if the gifts value is greater than a certain amount you may have an IRS reporting requirement. The tax is to be paid by the person making the gift but thanks to annual and.

How To Report A Foreign Gift Or Inheritance Of More Than 100k Schwartz Schwartz Pc

Form 3520 Reporting Foreign Trusts And Gifts For Us Citizens

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Inheritance Or Gifts From Foreign Persons May Require Form 3520 Reporting Shindelrock

Inheritances And Gifts With A Foreign Element Rodl Partner

Tax Tips And Traps Related To Foreign Gifts Gift From Foreign Person Youtube

Irs Expands Crypto Question On Draft Version Of 1040 Financial Planning

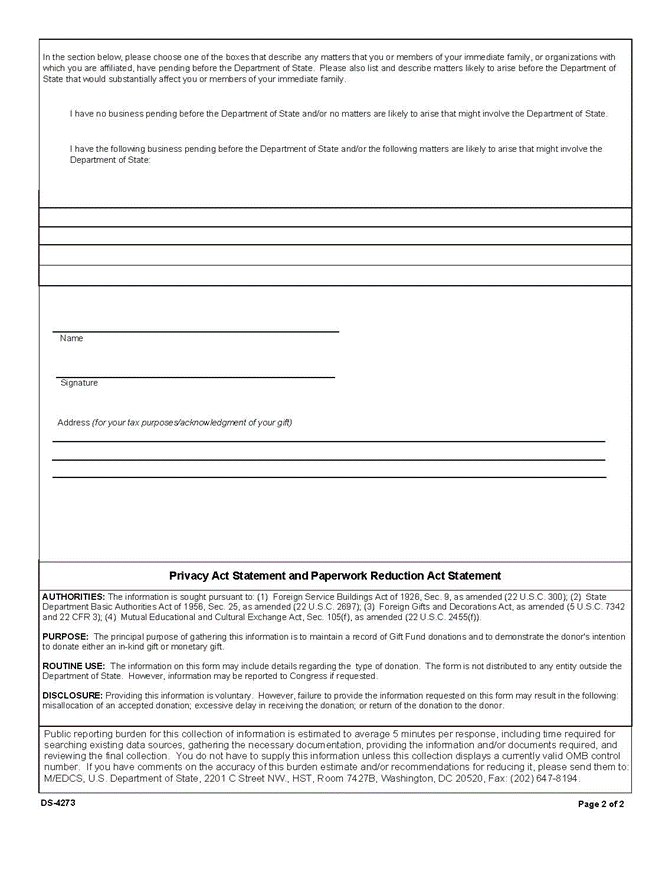

2 Fam 960 Solicitation And Or Acceptance Of Gifts By The Department Of State

Foreign Gift Tax Ultimate Insider Info You Need To Know For 2022

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Understanding The Rules Of Gifting Brooklyn Fi

What Is The Gift Tax In India And How Does It Affect Nris

Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts

Irs Foreign Reporting Tax Example 2018 Accounts Assets Gifts

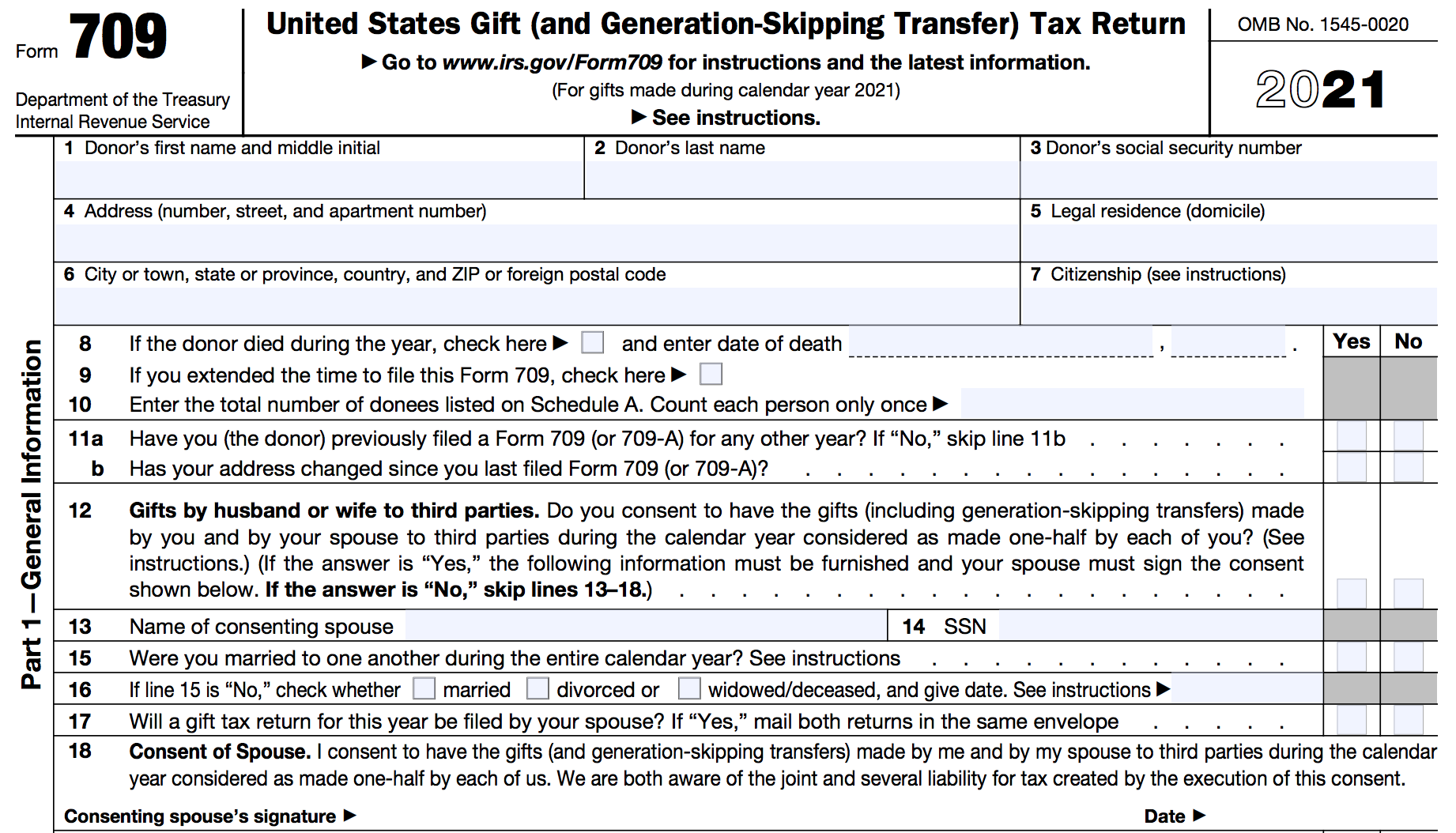

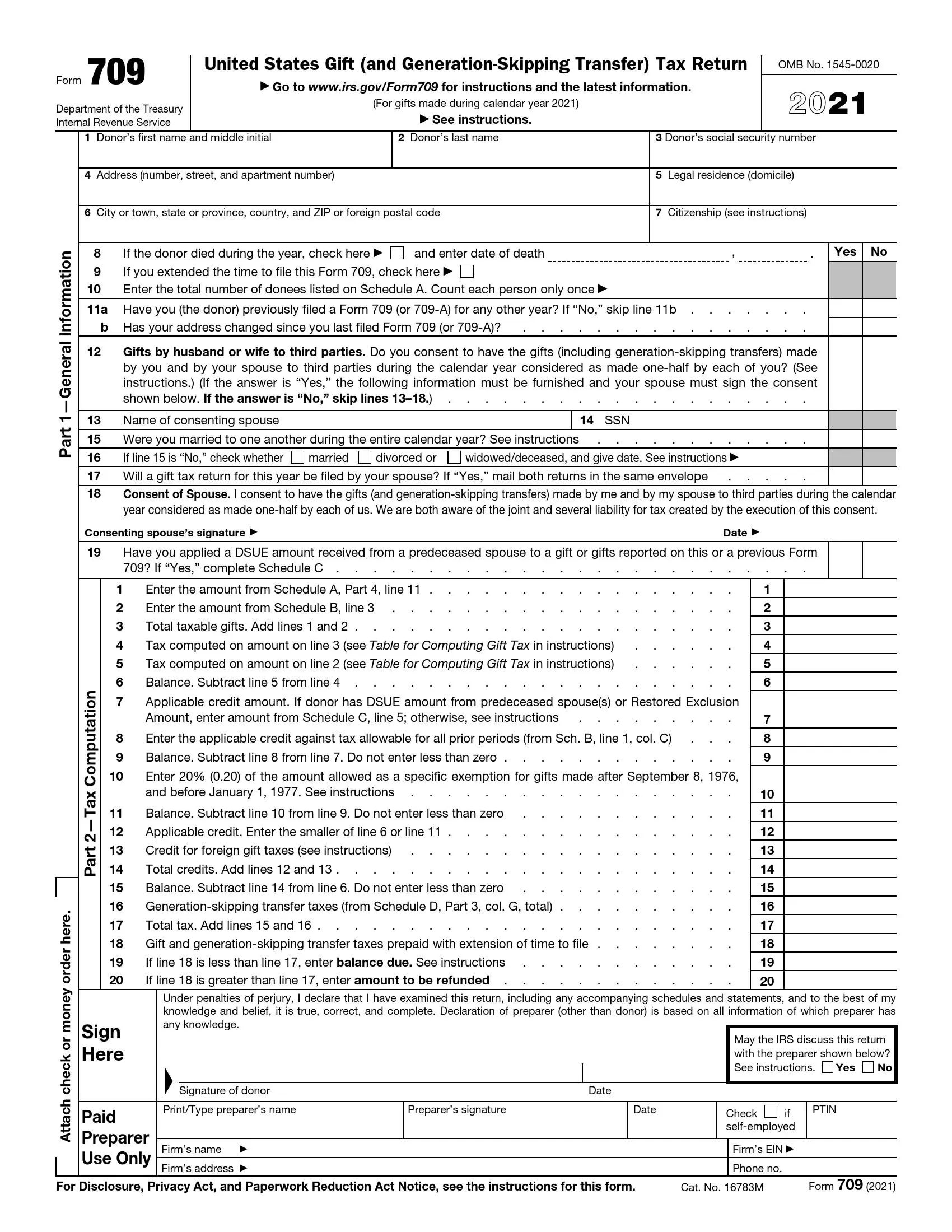

Irs Form 709 Fill Out Printable Pdf Forms Online

Do Cash Gifts Count As Income 1040 Com Blog

Form 3520 Top 6 Traps Expat Tax Professionals